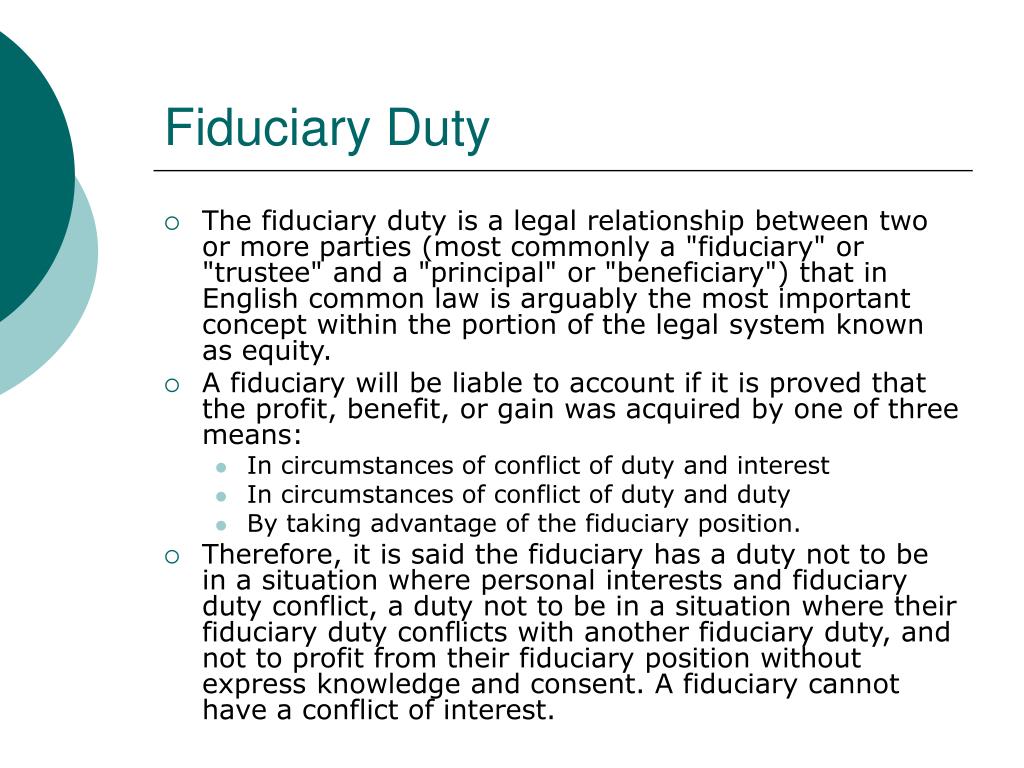

It is likely not going to be enough to simply point to the principal and claim, “he said it was okay.”Īs examples, the following are examples of Texas court holdings regarding fiduciary obligations: In that situation, the fiduciary should be able to point to independent advice from an attorney or accountant regarding the fairness of the transaction. the fiduciary fully and fairly disclosed all important information to the principal the transaction. the fiduciary placed the interests of the principal before his or her own, did not use the advantage of his or her position to gain any benefit for himself or herself at the expense of the principal and did not place himself or herself in any position where his or her self-interest might conflict with their obligations as a fiduciary andĮ. the fiduciary acted in the utmost good faith and exercised the most scrupulous honesty toward the principal andĭ. the fiduciary made reasonable use of the confidence that principal placed in him or her andĬ. the transaction in question was fair and equitable to the principal andī. In order to prove fairness, the fiduciary must show:Ī. Unlike most evidentiary presumptions, the presumption of unfairness involving a fiduciary self-dealing transaction is substantive and shifts both the burden of producing evidence, and the burden of persuasion with regard to fairness, to the self-dealing fiduciary. The court will presume the transaction is unfair, unless the fiduciary can prove the fairness. (f) The duty to place the best interest of the principal above the interest of the fiduciary, and not use the position of fiduciary to gain any form of benefit for the fiduciary at the expense of the principal.įiduciaries must be careful when engaging in any transactions with a principal to whom they owe a fiduciary duty.

#Breach of fiduciary duty meaning full

(e) The duty of full disclosure of all important and/or material information concerning any self-dealing transaction. (c) The duty to refrain from all forms of self-dealing, which extends to dealings with a fiduciary's spouse, agents, employees, and other persons whose interests are closely identified with those of the fiduciary. (a) The duty of fair dealing and utmost good faith. Where a family relationship results in one person being accustomed to being guided by the judgment or advice of another or justified in believing the other will act in the person's best interest, a confidential relationship may arise.Ī fiduciary typically owes the following general duties to the principal:

An informal fiduciary relationship exists “where there has been a special confidence reposed in one who, in equity and good conscience, is bound to act in good faith and with due regard for the interests of the one reposing the confidence.” Family relationships, where a person trusts in and relies upon a close member of the person's core family unit, may give rise to a fiduciary duty when equity requires. In an informal relationship, however, the circumstances surrounding a transaction must be examined to determine whether one is acting as another's fiduciary. Proof of the position or status is enough to prove the fiduciary relationship. The status-based relationship itself will give rise to a fiduciary duty as a matter of law. In a formal relationship, the fiduciary owes heightened duties by virtue of his position or status. In addition, general fiduciary duties also includes the duty of full disclosure which requires disclosure of all important information concerning any transaction, including any matters that might influence a fiduciary to act in a manner prejudicial to the principal.įiduciary relationships may arise in formal or informal situations. General fiduciary duties include the duty of loyally and utmost good faith, as well as, the duty of fair and honest dealing. It is often stated that a fiduciary duty is the highest duty of trust and confidence under the law.

0 kommentar(er)

0 kommentar(er)